CMC Preferred Provider DocProbe provides a cost-effective,

turn-key solution for your trailing docs.

DocProbe provides end-to-end document services to mortgage lenders and investors.

Lenders can lower their fixed overhead costs and improve their bottom line with variable fees,

process efficiencies, no long-term contracts, and DocProbe's no-penalty guarantee.

Discover Why CMC Patrons Choose DocProbe

Efficiencies

Move away from expensive fixed costs by shifting to a variable cost structure

Easy-to-Understand Fees

Shipping fees included in per-file pricing

Easy to try

No commitments!

Special Pricing for CMC Patrons

Waived account implementation fee ($500 value) and $2 off new file set-up fee

DocProbe Services

Loan Document Retrieval

DocProbe’s purpose is to eliminate the document retrieval headache for lenders, investors and servicers.

Title Policy Retrieval

DocProbe provides lenders and servicers with an automated title policy retrieval solution that streamlines the process and satisfies investor requirements.

Imaging & Indexing

At DocProbe, we specialize in document imaging and indexing specifically for real estate investors, lenders, and real estate firms.

Document Warehousing

DocProbe can store all documents in one place, providing real-time access 24/7 to each and every document from anywhere in the world.

|

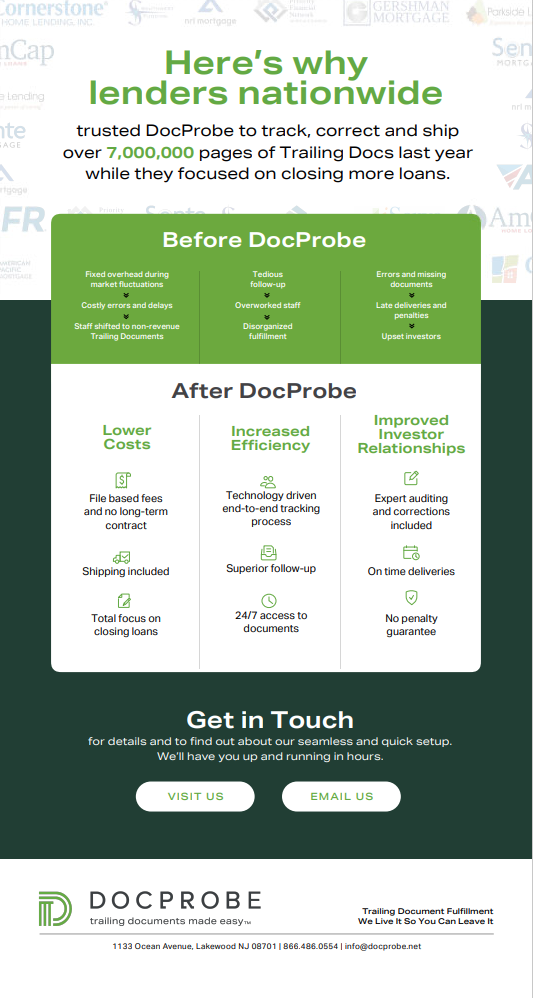

Lenders trusted DocProbe to track, correct, and ship over 7,000,000 pages of trailing docs in 2020.

|

Top 3 Benefits of DocProbe

| 1. STOP THE TRAILING DOCUMENT HEADACHES FOREVER

Chasing loan and title documents after closing is a thankless job. It is both time-consuming and challenging… but it is also a necessity. Obtaining copies of documents post closing ensures the loan file is complete without any “loose ends.” DocProbe’s eliminates the lender’s document retrieval headache. Their network of researchers, sophisticated technology and robust research process ensures trailing docs are obtained in systematic, efficient, quick and trackable manner.

|

| 2. AVOID PENALTIES & PROTECT YOUR INVESTOR RELATIONSHIPS

In today’s market, investors expect to receive trailing documents for every loan in a timely manner from their lenders. Gone are the days when no one noticed or cared if trailing documents were missing. It is in every lender’s best interest to stay ahead of the paper chase to avoid penalties and ensure trailing documents don’t get between you and your investors.

|

|

3. MAKE TRAILING DOCS MORE COST EFFECTIVE

Staff salary and benefits make it a profit-drain for any lender to track trailing documents after closing. DocProbe can chase, store and ship trailing docs for less than most lenders can do it themselves. Their economy of scale makes it possible for them to process post closing loan documents for much less than doing it in-house. Passing off this tedious task to DocProbe not only helps avoid paperwork headaches and investor hassles, but can also save money.

|